IMPORTANT UPDATE:

For the full PDF with clickable links, please CLICK HERE

Welcome to the Assessor’s section of the Neptune Township Website

Quick Links:

- Online Appeal System

- Monmouth County Open Public Record Search

- Tax Board Portal (T.I.A.R.A, Income and Expense, Farmland)

- Neptune Township Tax Maps

- Forms (Deductions, Exemptions, Appeals)

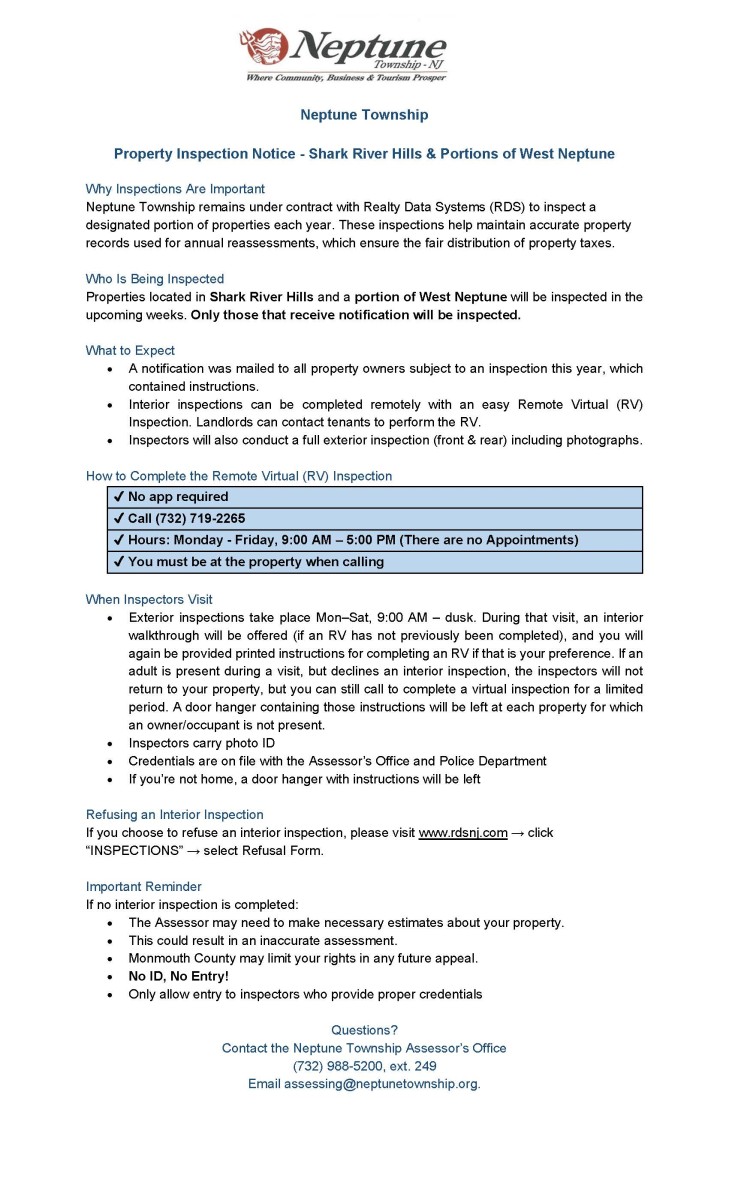

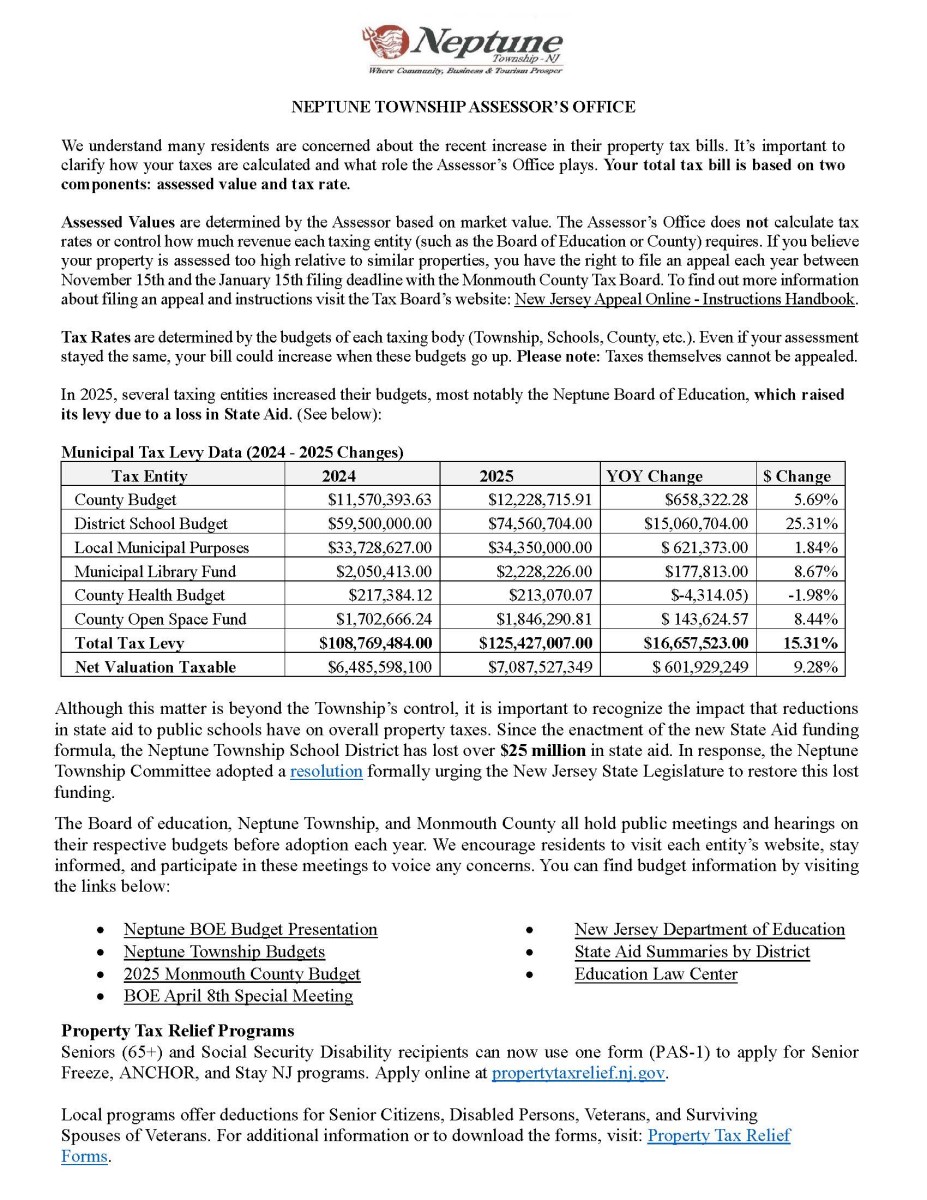

Announcements from the Assessor’s Office

_________________________________________________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________________________________

What is an Assessor?

_________________________________________________________________________________________________________________________________________________________________________________

The Assessor is a local government official who estimates the value of real property within a city, town, or village’s boundaries. This value is converted into an assessment, which is one component in the computation of real property tax bills. The Assessor is responsible to the citizens of Neptune Township for the fair assessment of all property in order that the tax burden be distributed equitably. This office strives to keep the public well informed on all tax assessment matters.

_________________________________________________________________________________________________________________________________________________________________________________

Responsibilities of the Assessor

Discovery and location of all real property and certain personal property used in business in the taxing district;

- Listing and description of property in a systematic, convenient manner through the NJ Property Tax System known MOD IV;

- Determination of taxability based on a wide variety of tax exemption and tax deduction statutes;

- Valuation of property through an appraisal of each property and an assessment based on that appraised value;

- Tax equalization responsibilities via district revaluation programs and for purposes of distributing State Aid to schools;

- Defense of assessments upon appeal.

Contact Us:

_________________________________________________________________________________________________________________________________________________________________________________

Nick Megill, Assessing/Land Use Inspector

P: 732-988-5200, extension x 249

E: nmegill@neptunetownship.org

George Waterman, CTA, Deputy Assessor

P:732-988-5200 extension x 217

E: gwaterman@neptunetownship.org

A. Dawn Crozier-Freeman, CTA, Assessor

P: 732-988-5200, extension x 247

E: dfreeman@neptunetownship.org

Assessor’s Office Fax:

732-988-4259