TAX OFFICE HOURS:

Thru August 29th

Mon-Thurs

8AM to 4PM

Fri

8AM to 1PM

PAY YOUR PROPERTY TAXES & SEWER UTILITY * ONLINE NOW!

Click here to pay your taxes & sewer utility online (online Bill Pay)

*Excludes properties billed by OGSA*

For questions regarding the amount of your bill, contact the Tax Offices at (732) 988-5200 x 243

To sign up for alerts regarding tax and sewer payments, please CLICK HERE

Please CLICK HERE for instructions on this program

Property Tax Relief

Please CLICK HERE for the PAS-1 Application for Seniors and Social Security Disability Recipients

Tax Collection Department

Ext 243 Ahmya Crozier

Ext 224 Frank Criscola

Ext 251 Lilian Bedrosian

Ext. 244 Ana Dawson

Ext 246 Melanie Manning, CTC, Deputy Tax Collector

Ext 240 Michele Narciso, CTC, Tax Collector

MAKE CHECKS PAYABLE: Township of Neptune

MAIL TO: TOWNSHIP OF NEPTUNE

PO BOX 1167

NEPTUNE, NJ 07754-1167

OVERNIGHT ADDRESS:

TOWNSHIP OF NEPTUNE

25 NEPTUNE BLVD

NEPTUNE, NJ 07753

TEL.: 732-988-5200 ext. 251

FAX: 732-775-7600

Questions? email collector@neptunetownship.org

TAX DUE DATE INFORMATION

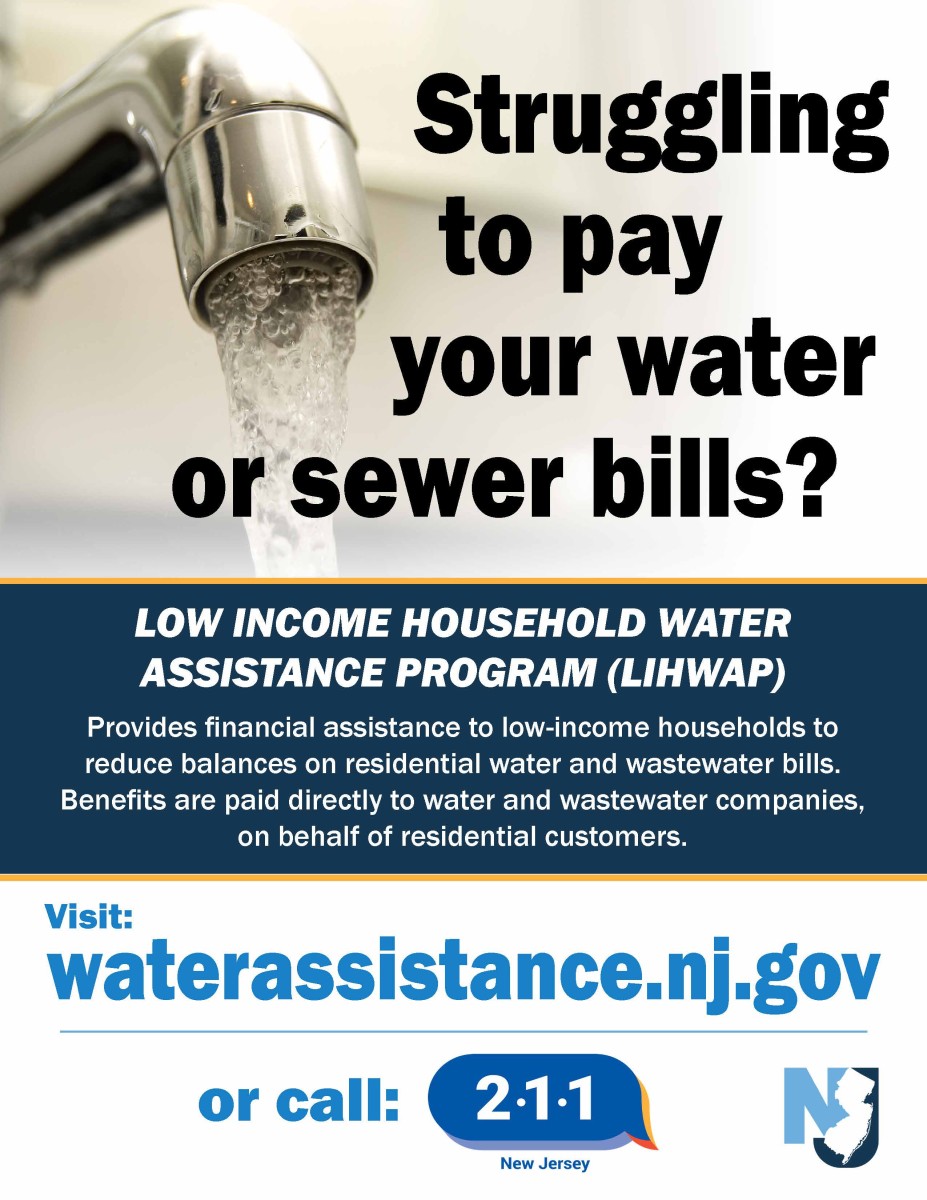

Sewer Utility

Sewer Charges are due on the first day of MARCH and SEPTEMBER. Interest at a rate of 8% per annum up to $1500.00 (taxes and sewer combined) will be charged on all payments made more than thirty (30) days after the due date, to be calculated from the date the sewer rent was payable until the date payment is received in the Tax & Sewer Collection Office. Interest will be chargd at a rate of 18% per annum on balances in excess of $1,500.00 (taxes and sewer combined). If payment is made by mail and you wish to receive a receipt, send entire sewer bill and a self-addressed stamped envelope along with your payment.

If you do not desire a receipt, simply enclose the appropriate stub with your payment.

Property Tax

Due dates: (10 Day grace period)

1st Quarter- February 1st

2nd Quarter- May 1st

3rd Quarter- August 1st

4th Quarter- November 1st

APPEALS: The Tax Collector does not make assessments nor has the authority to change any assessment or cancel any taxes. Errors in assessment should be referred to the Assessor.

Interest will be charged at 8% up to $1500.00 and interest will be charged at 18% for delinquent taxes in excess of $1,500.00. A penalty of up to 6% may be charged on any delinquency in excess of $10,000.00 if not paid by the end of the fiscal year. If the Municipal Offices are closed on the 10th of the month in which taxes are due, the grace period is extended to the following business day.

TAX SALE: Any municipal charge remaining unpaid on the eleventh day of the eleventh month of the current fiscal year is subject to Tax Sale at anytime thereafter (Cp. 99, PL. 1997)

Tax Relief Information

Please CLICK HERE for more information

Click on the links below for special forms:

Senior Citizen-Disabled Person Deduction Application

Veteran Deduction Application Veteran Supplemental Application